(5) Any other amounts that are subject to yield limitations under the rules applicable to tax-exempt bonds under the Internal Revenue Code. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades.

- Whereas it may take a little longer for components of the M2 money supply to convert or be liquidated, the M1 money supply more often changes due to the ease of being able to transact.

- Think of a money market account as a checking and savings hybrid account.

- With a NOW account, the bank or credit union has the right to require at least seven days written notice of a withdrawal, though this is rarely done.

- M1 is the money supply that is composed of currency, demand deposits, other liquid deposits—which includes savings deposits.

- Robinhood Financial LLC (member SIPC), is a registered broker dealer.

- A term deposit forces you to set aside the money you deposit for a set period.

Most DDAs are personal accounts that are simple to open at most banks and require a low minimum to own the account. A person using a checking account can deposit and withdraw money as many times as they want with no limits, which is an example of a demand deposit account. Although, savings accounts may have a fee attached to withdraws once a person exceeds a withdraw limit. Savings accounts are used for long-term deposits while checking accounts are for more short-term deposits and withdraws and usually have no limits. Banks can pay interest on demand deposit accounts, though, with checking accounts, this typically isn’t the norm. Instead, you’re more likely to earn interest on a savings account.

The Bankrate promise

If you are saving for a short-term goal like a vacation, a new car, a wedding or the down payment on a home, a time deposit account might be a good place to keep your short-term savings. But banks can limit the number of withdrawals you can make from an MMA, just as they can with savings accounts. For example, you may be restricted to six withdrawals per month before an excess withdrawal fee kicks in. In terms of whether CDs or money market accounts pay better interest rates, this can depend on the type of CD or MMA and where you’re opening it. For example, if you’re married, you might have individual checking accounts in your name, a joint checking account and a joint savings account. Banks generally don’t limit the number of demand deposit accounts you can have.

- While most DDAs allow you to get your money whenever you want, some accounts may require you to give up to seven days’ notice.

- A reserves requirement is the amount of deposits that a bank is required to hold in reserves and not loan out.

- Demand deposit accounts generally earn little to no interest compared to time deposit accounts.

- There are other types of accounts, such as bank money market accounts, that allow some flexibility when it comes to accessing the funds in the account.

- Upon the maturity of a security, we will pay the owner the principal amount and interest due.

SLGS securities are issued in book-entry form on the books of Fiscal Service. The W-4 is an Internal Revenue Service (IRS) form that new employees fill out to let their employers know how much tax to withhold from the employee’s paycheck each pay period. On March 26, 2020 the Federal Reserve example of demand deposit reduced the reserve requirement to 0%, where it remains as of February 2021. When you deposit money at a bank, the bank doesn’t lock the money in a vault and hold it until you ask for it back. It retains a portion of the money, but uses the remainder for other purposes, such as lending.

Why are demand deposit accounts important?

Demand deposit accounts, such as checking accounts, have both pros and cons. All bank accounts, including direct deposit accounts, have an account number that identifies the specific account. You have to use the account number when transacting with the account. According to law, banks must retain a certain amount of the money customers have deposited so the bank can return those funds to customers who ask for their money.

Maturity Transformation: What It Is and How It Works — Investopedia

Maturity Transformation: What It Is and How It Works.

Posted: Wed, 31 May 2023 07:00:00 GMT [source]

Though banks might not always enforce this rule with NOW accounts, it’s important to know that it exists. If you have a checking account, you already have experience with how a demand deposit account works. Demand deposits make up most of a particular measure of the money supply—M1. This is the sum of all of a nation’s demand deposits, plus all the currency in circulation. It’s a measure of the most liquid types of money in the money supply. The account’s holdings can be accessed at any time, without prior notice to the institution.

M1 Money Supply: How It Works and How to Calculate It

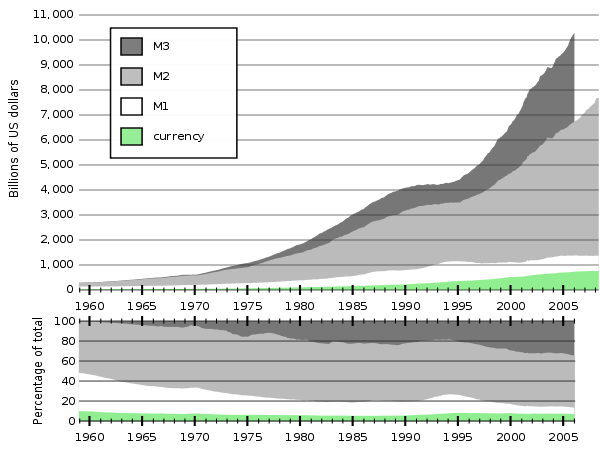

As of May 2022, the total amount of demand deposit accounts in the U.S.—officially, the total demand deposits component of M1—was $4.98 trillion. This compares to $1.4 trillion five years ago and $733 billion 10 years ago. M1 is the money supply that is composed of currency, demand deposits, other liquid deposits—which includes savings deposits. M1 includes the most liquid portions of the money supply because it contains currency and assets that either are or can be quickly converted to cash. However, «near money» and «near, near money,» which fall under M2 and M3, cannot be converted to currency as quickly. A demand deposit account (DDA) is any account set up to give customers a no withdraw limit and on-demand access to their money.

A DDA deposit, for example, is a transaction in which money is added to a demand deposit account—this may also be referred to as a DDA credit. Demand deposit debits are transactions in which money is taken out of the account. There are three kinds of Demand deposit accounts where you can deposit or withdraw your money.

Example of a demand deposit account

Demand deposit accounts include checking accounts, savings accounts and money market accounts. With a demand deposit account, you’re allowed to put money into the account or take money out of the account at any time, without penalty. A demand deposit account is very common in the United States banking system. A demand deposit is simply money held in an account that you can draw upon on demand.

Usually, the funds are used for normal life expenses and the bank pays little to no interest rate for the money stored in this account. There are many ways to make a demand on the bank for funds, including using the ATM, using a debit card, and making an online banking transfer. The Federal Reserve does place certain requirements on these accounts which creates liabilities on banks. Reserve requirements force financial institutions to regulate the types of accounts and the activity in these accounts. A demand deposit is a type of bank account that lets customers easily access their money. Certain demand deposit accounts can require up to six-days notice before a withdrawal, but otherwise do not limit withdrawals, such as having a maximum number of withdrawals per statement period.

And if you’re saving for retirement or want to grow your wealth, investment accounts like IRAs and mutual funds can help. Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can. (3) Include the information required under paragraph (b) of this section, if not already provided. (6) Include the information required under paragraph (b), if not already provided. For each security, the issuer shall designate an interest rate that does not exceed the maximum interest rate shown in the daily SLGS rate table as defined in § 344.1.

Is a Full-Blown 2008-Style Banking Crisis Just Around the Corner? — International Banker

Is a Full-Blown 2008-Style Banking Crisis Just Around the Corner?.

Posted: Mon, 19 Jun 2023 06:00:49 GMT [source]

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Managing Editor, Global Data and Automation for Forbes Advisor.